des moines new mexico sales tax rate

Dixon NM Sales Tax Rate. New Mexico has recent rate changes Wed Jan 01 2020.

Wholesale Sales Tax Explained Taxjar

New Mexico Sales Tax Rate The gross receipts tax rate in New Mexico varies throughout the state from 5125 to 88675.

. Eagle Nest NM Sales Tax Rate. The Iowa sales tax rate is currently. About 16 tax on a 100 purchase.

The Des Moines sales tax rate is. New Mexico has a gross receipts tax that applies to anyone doing business in the state. The Des Moines New Mexico sales tax is 513 the same as the New Mexico state sales tax.

This is the total of state county and city sales tax rates. With local taxes the total sales tax rate is between 51250 and 92500. The Des Moines Sales Tax is collected by the merchant on all qualifying sales made within Des Moines.

New Mexico NM Sales Tax Rates by City. Rates include state. The gross receipts tax rate varies throughout the state from 5125 to 88675 depending on the location of the business.

Des Moines is located within Union County New Mexico. In most cases a business will pass the tax on to the customer in the form of a sales tax. The average cumulative sales tax rate in Des Moines New Mexico is 606.

Derry NM Sales Tax Rate. Duran NM Sales Tax Rate. The sales tax rate does not vary based on zip code.

The County sales tax rate is. Doña Ana County NM Sales Tax Rate. This is the total of state county and city sales tax rates.

513 The Des Moines Sales Tax is collected by the merchant on all qualifying sales made within Des Moines Groceries are exempt from the Des Moines and New Mexico state sales taxes Des Moines collects a 0 local sales tax the maximum local sales tax allowed under New Mexico law Des Moines has a. Des Moines voters approved a 1 percent local option sales tax in 2019 bringing its total sales tax rate to 7 percent. The current state sales tax rate in New Mexico NM is 5125 percent.

3 rows The Des Moines New Mexico sales tax rate of 60625 applies in the zip code 88418. Lowest sales tax 55 Highest sales tax 94375 New Mexico Sales Tax. Future job growth over the next ten years is predicted to be 222 which is lower than the US average of 335.

This year the city plans to maintain its rate at 1661. The VAT is a sales tax that applies to the purchase of most goods and services and must be collected and submitted by the merchant to the Mexico governmental revenue department. This is the total of state county and city sales tax rates.

The average combined tax rate is 7775 ranking 15th in the US. The average local rate is 265. 2022 List of New Mexico Local Sales Tax Rates.

Datil NM Sales Tax Rate. View the current Gross Receipts Tax Rate Schedule. All numbers are rounded in the normal fashion.

Deming NM Sales Tax. The current Mexico VAT Value Added Tax is 1600. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 706 in New Mexico.

What is the sales tax rate in Des Moines Iowa. Des Moines IA Sales Tax Rate. The present market value of real property found in Des Moines is calculated by county assessors.

The December 2020 total local sales tax rate was also 7000. Groceries are exempt from the Des Moines and Washington state sales taxes. How to Register for New Mexico Sales Tax.

The Republican governor has also proposed income tax rate cuts over the next four years that would result in a 4 state flat tax by 2026. To calculate the sales tax amount for all other values use our sales tax calculator above. However left to the county are evaluating property mailing levies bringing in the tax conducting compliance programs and clearing up discord.

The minimum combined 2022 sales tax rate for Des Moines New Mexico is. The minimum combined 2022 sales tax rate for Des Moines Iowa is. While many other states allow counties and other localities to collect a local option sales tax New Mexico does not.

Dulce NM Sales Tax Rate. The current total local sales tax rate in Des Moines IA is 7000. Dexter NM Sales Tax Rate.

Des Moines sets tax levies all within the states constitutional guidelines. Des Moines which passed a penny sales tax in 2018 lowered its property tax rate by 60 cents in 2019. New Mexico Sales Use Tax Information.

Depending on local municipalities the total tax rate can be as high as 90625. Dora NM Sales Tax Rate. Exact tax amount may vary for different items.

The County sales tax rate is. The total tax rate might be as high as 90625 percent depending on local governments. The Des Moines County Sales Tax is 1.

The Des Moines Washington sales tax is 1000 consisting of 650 Washington state sales tax and 350 Des Moines local sales taxesThe local sales tax consists of a 350 city sales tax. Des Moines has seen the job market decrease by -13 over the last year. Colorado has the lowest sales tax at 29 while California has the highest rate at 725.

The New Mexico NM state sales tax rate is currently 5125 ranking 32nd-highest in the US. Only in its effect on the buyer does the gross receipts tax resemble a sales tax. 10 rows Total Sales Tax Rate.

Here is the table with the State Income Taxes in. Five states have no sales tax. Wayfair Inc affect Washington.

The New Mexico sales tax rate is currently. The sales tax rate in Des Moines New Mexico is 78. Doña Ana NM Sales Tax Rate.

Last year the average property taxes paid was 06 Des Moines New Mexico. Des Moines NM Sales Tax Rate. Tax Rates for Des Moines - The Sales Tax Rate for Des Moines is 61.

This includes the sales tax rates on the state county city and special levels. The latest sales tax rates for cities in New Mexico NM state. New Mexico has state sales tax of 5125 and allows local governments to collect a.

Within Des Moines there is 1 zip code with the most populous zip code being 88418. Average Sales Tax With Local. The state sales tax rate in New Mexico is 51250.

The Most Expensive States To Own A Car U S News

What A National 15 Minimum Wage Actually Means In Your State Mark J Perry Map Cost Of Living States

King County Wa Property Tax Calculator Smartasset

How Much You Really Take Home From A 100k Salary In Every State

Anil On Twitter States In America America States

We Used Data And Science To Determine The Whitest States In America States In America America States

Washington Sales Tax Rates By City County 2022

How Much You Really Take Home From A 100k Salary In Every State

How Much You Really Take Home From A 100k Salary In Every State

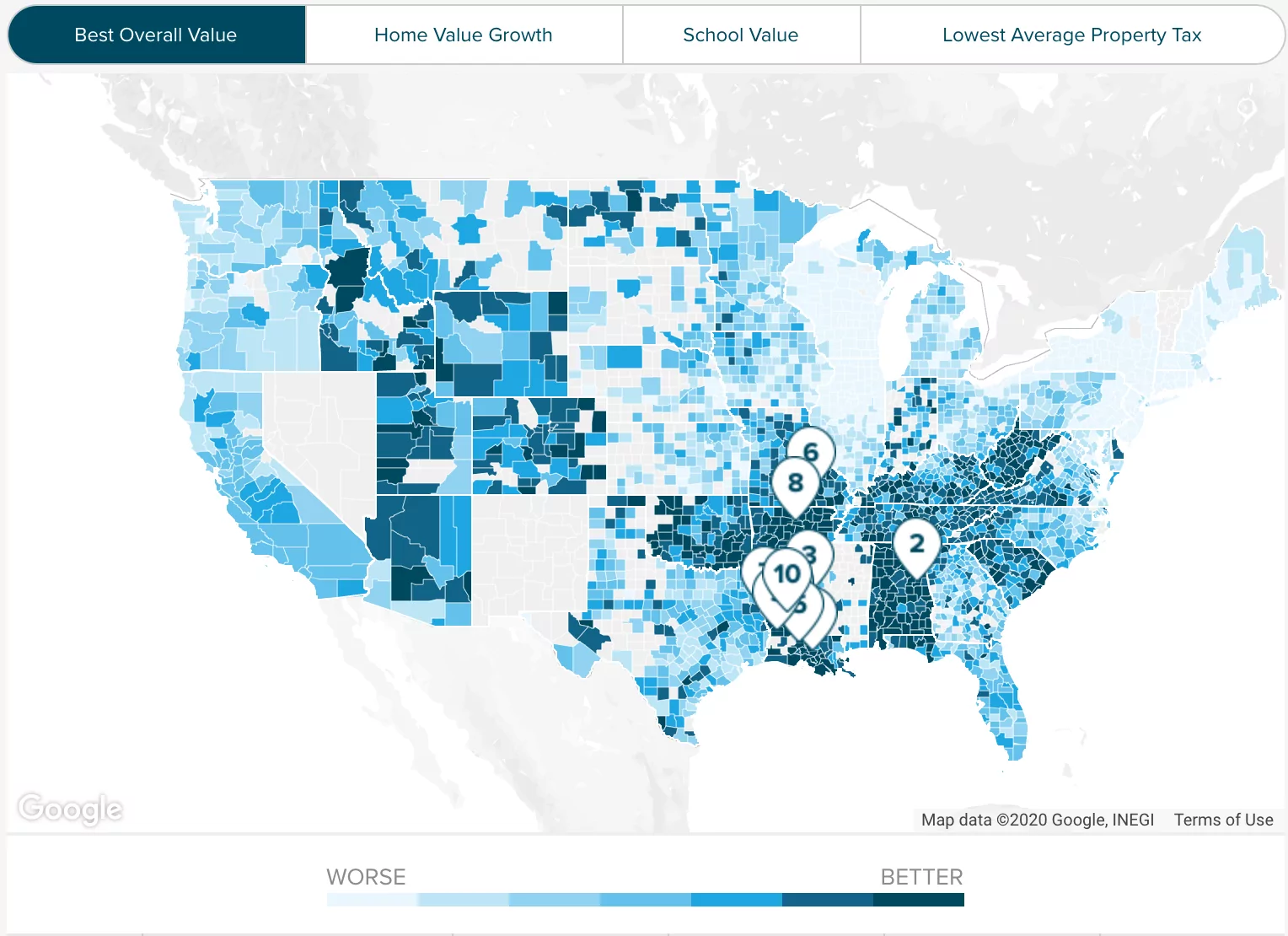

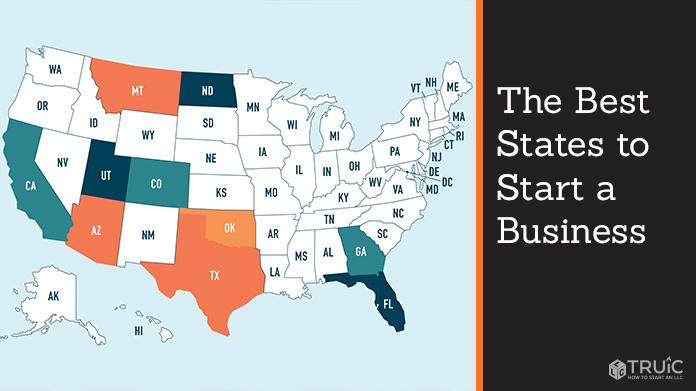

Best States For Business The 10 Best States To Start A Business

Howard Miller Grange Hall 27 5 In 2022 Unique Wall Clocks Gallery Wall Clock Rustic Gallery Wall

How Much You Really Take Home From A 100k Salary In Every State